How IBC Turns Liabilities Into Assets

Assets Vs Liabilities – It depends on perspective

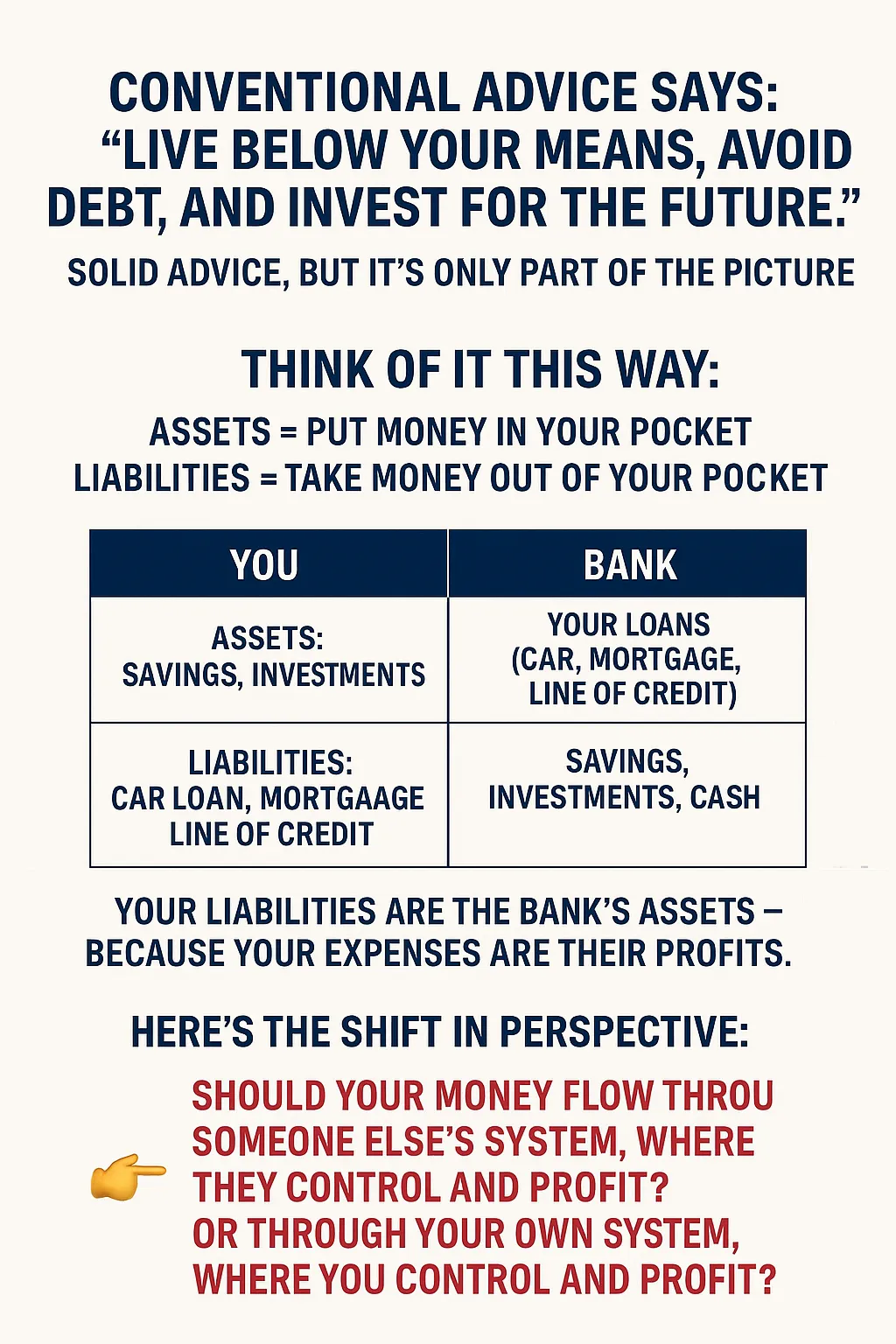

Conventional financial advice states “live below your means, avoid debt and interest payments, invest for the future”. This is great advice, and is likely the most important piece of the financial equation, but its not the entire equation.

Assets can be simply defined as “something that puts money into your pocket”. Liabilities can be just as simply defined as “something that takes money out of your pocket”.

Lets break down how assets and liabilities look for you vs a bank

You can see that the bank is quite literally the opposite of you and I. But why? Simply put, your expenses are the banks profits.

Here’s the shift in perspective:

Everyone in Canada uses a bank, which means their money flows through the banking system for both their assets and liabilities. But what if you could build your own personal banking system?

If you owned the system, your liabilities would now become assets that generate profit for you. The same interest that banks collect to grow their wealth could be flowing back into your own financial system. You also retain control over your liabilities because you control the banking system. Control = repayment on your terms, your schedule, not someone else’s.

Since your money already currently flows through someone else’s banking system, why not create your own and profit from what you are already doing? You don’t have to change your habits, you only have to change how you look at the problem, and determine which direction your money is flowing. Through someone else’s banking system, where they have control and they profit, or through your own system which you control and profit from. The choice is easy once you fully understand the problem.